Before investing in DMG blockchain stock, you should be aware of the risks involved. Let’s take a look at what this blockchain company does and how it can benefit your investment. We’ll also discuss the company’s acquisition of Blockseer and the management’s role. Read on to find out more! DMG Blockchain Stock – Why It’s a Good Investment

DMG stock

DMG blockchain stock is a cryptocurrency and blockchain solution provider based in Canada. The company provides end-to-end digital solutions and manages the crypto currency ecosystem. It was founded on April 18, 2011 and is headquartered in Christina Lake, Canada. Its revenue is generated from mining bitcoin and selling crypto-mining hardware to industrial mining clients. DMG has a track record of delivering solutions to clients and is one of the fastest-growing companies on the blockchain.

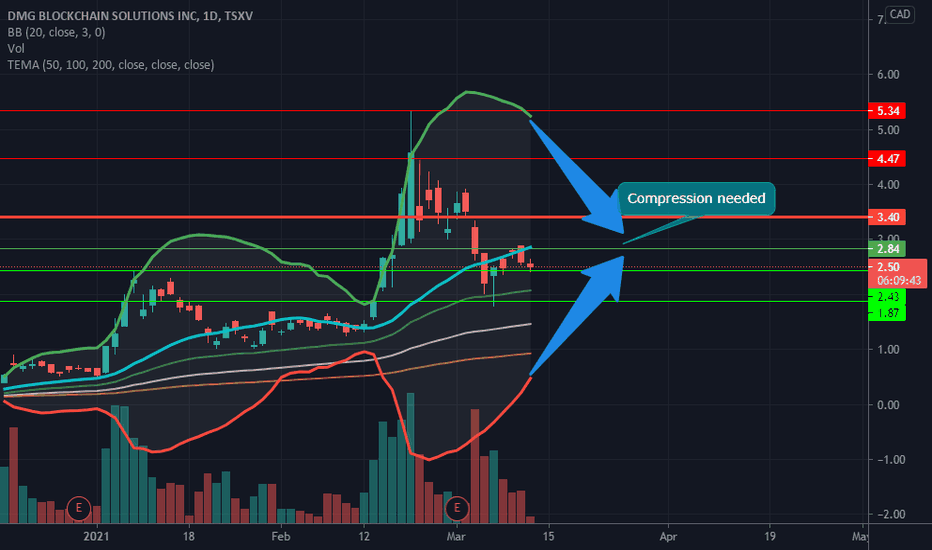

DMGI’s technical analysis is very similar to that of other blockchain stocks, but there is a key difference. This cryptocurrency is much more scalable and has a wider range of applications. DMGI’s infrastructure is based on a distributed ledger technology that runs on a blockchain network. It also integrates with various financial systems, including banking, finance, and energy. Because of the nature of its technology, DMGI stock is expected to increase in value over time.

Blockseer acquisition

DMG Blockchain Solutions Inc. has announced that it has acquired a subsidiary of Blockseer, a California-based private company. Following the acquisition, DMG’s U.S. subsidiary will acquire all of Blockseer’s outstanding shares. The deal is subject to TSX Venture Exchange approval. Blockseer is based in Silicon Valley, California and is incorporated under Delaware law. After the acquisition, DMG intends to focus on safety and security and regulatory and compliance.

DMG Blockchain has issued approximately one million stock options to its employees. The stock price of DMG shares is approximately $1.41. While DMG stock remains a speculative investment, its blockchain capabilities are a promising asset class. The company’s recent partnership with Brane will help it enter the custody market sooner than other firms. Additionally, this acquisition complements the company’s other planned technology investments. Therefore, DMG will be able to reap significant benefits from its partnership with Brane.

The DMG investment is expected to accelerate market traction for Brane and foster cooperation on advanced blockchain technologies. The DMG investment is expected to further the company’s goal of environmental sustainability, without compromising its independence as a custodian. The company will maintain strict separation of its cryptocurrency trading operations from its other assets. It has also signed the Crypto Climate Accord, a framework promoting the decarbonization of the cryptocurrency industry.

DMG is a vertically integrated blockchain company that develops end-to-end digital solutions. The company’s non-polluting data centres earn eco-friendly revenues from bitcoin mining. Additionally, it offers hosting services for industrial mining clients. Finally, the company’s data analytics and forensics division provides technical expertise to law enforcement organizations and auditing firms. DMG Blockchain stock acquisition continues to offer investors an opportunity to own shares of this promising company.

DMGI’s management team

The DMG Partners’ team of professionals have nearly 100 years of combined experience, and the Senior Team consists of diverse talent with outstanding backgrounds and skill sets. They also have diverse interests and continually push themselves to the limit. Here are the top executives in the company. They’ve put in the work and earned the respect of their peers. Let’s take a look at each of them. What makes them great? You might be surprised!

Currently, DMG Blockchain Solutions Inc. is a vertically integrated blockchain technology company. Its management team is comprised of ecologists, forensic & financial professionals, blockchain developers, and crypto experts. In addition to its management team, the company has awarded 2,730,000 stock options to its directors. This recent addition demonstrates the strength of its leadership team. DMGI’s management team is poised to succeed in the next phase of its growth by delivering on expectations and ensuring the success of the business.

The agreement may not be modified without DMGI’s written consent. Any amendments must be approved by the Board of Directors and the Compensation Committee. DMGI will retain all records. You will be subject to any and all records provided to DMGI. If you do not agree to any of the provisions in this Agreement, you should not continue to work for DMGI. This contract provides you with the tools you need to succeed.

The DMG field construction management team is the company’s “nuts and bolts.” They ensure that the projects are installed properly and on time. They coordinate with general contractors and attend weekly job site coordination meetings. They also report any issues or concerns that arise, so that you’re not left in the dark. The DMG management team is also supported by assistant project managers. This is to ensure the DMG customer receives what they need from the company.

Risks of investing in DMGI stock

Investing in DMGI shares entails some risks. Despite being a well-established and stable company, DMGI shares are still considered speculative. In this article, we will talk about the risks of investing in this stock. If you’re thinking about buying it, here are some important things to consider:

There are two types of risks associated with investing in DMGI stock. There are two types of risk – Upside Potential and Value At Risk. This information is critical for making an informed decision regarding whether or not to invest in DMGI BLOCKCHAIN. As such, a recommendation should be complemented with buy-or-sell advice from a financial adviser. In addition to these risks, investors should pay special attention to the price distribution of DMGI BLOCKCHAIN.

– Revenue growth. Since DMG Blockchain Solutions isn’t profitable yet, revenue growth is not expected to be high in the near future. Hence, most analysts look at revenue growth as a leading indicator of future growth. However, this may not be the case. Revenue growth may be slower than projected, which may lead to poor results. The company also has a long way to go before its products and services are marketed.